2025 started with a furry of news and activities that may have further implacations on companies in the portfolio. The 2 key events I kept my eyes on was the following.

LA Wildfire Crisis: A Government Failure

The LA wildfire crisis exposed major government inefficiencies. Regulatory price fixing forced insurance providers to exit the market, leaving homeowners with fewer options and rising costs. Additionally, slow emergency response, bureaucratic red tape, and poor coordination worsened the crisis, prioritizing politics over real solutions.

Both Berkshire and Markel are in the reinsurance space. Their exposure to the LA wildfire could have a temporary impact on their earnings if insurance products were mispriced. This crisis should give further insights to their underwriting discipline.

Deepseek and the AI Paradigm Shift

Deepseek challenges the idea that AI must rely on the most advanced GPUs, signaling a shift in Big Tech’s capital expenditure strategy. This could disrupt Nvidia’s dominance and reduce energy demands for large-scale AI deployments. If widely adopted, this approach may reshape the AI and semiconductor industries.

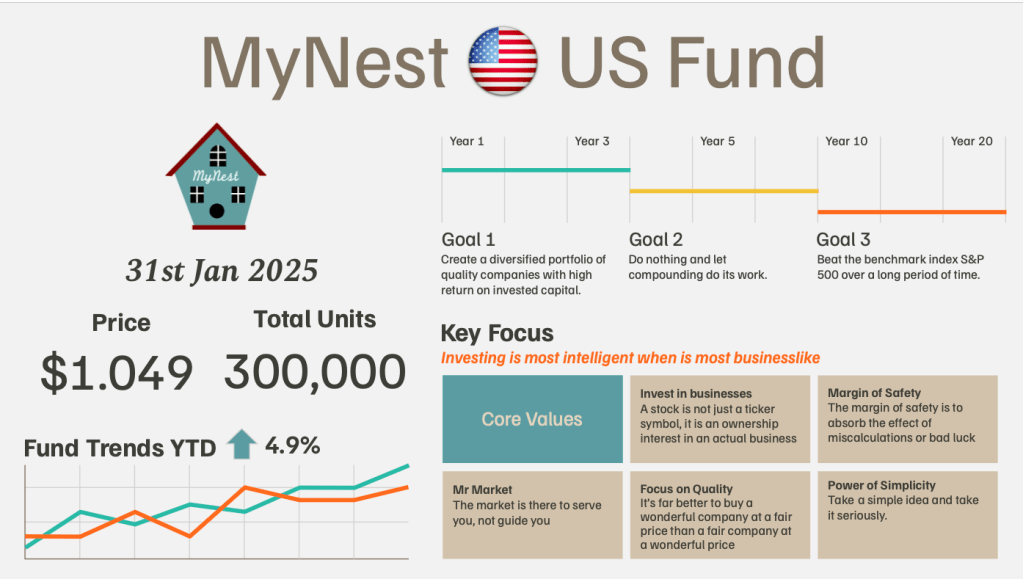

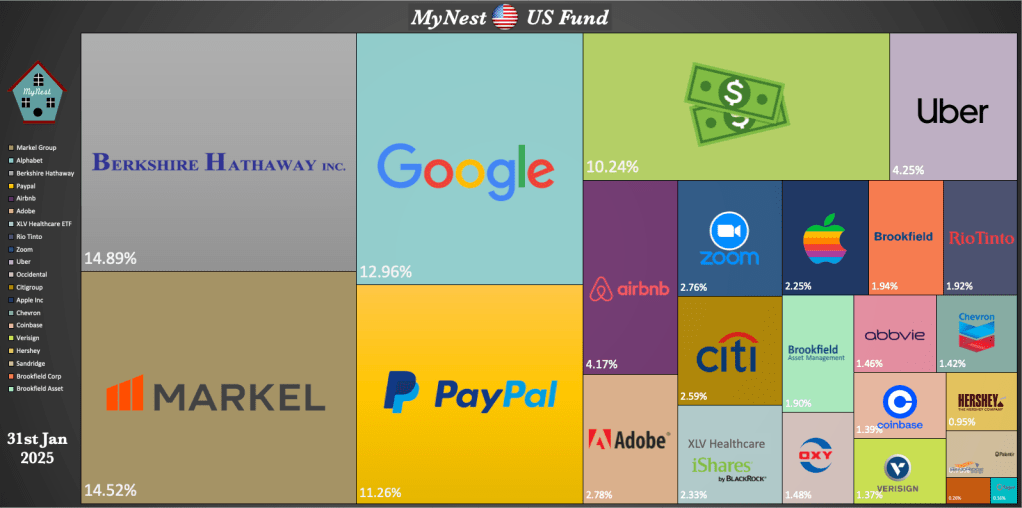

MyNest US Fund Portfolio Compositions

The Fund portfolio composistion were little changed as we enter into the earnings season. The US stock market was generally positive and investors were buzzing with optimism that the new president would enact business friendly economic policies.

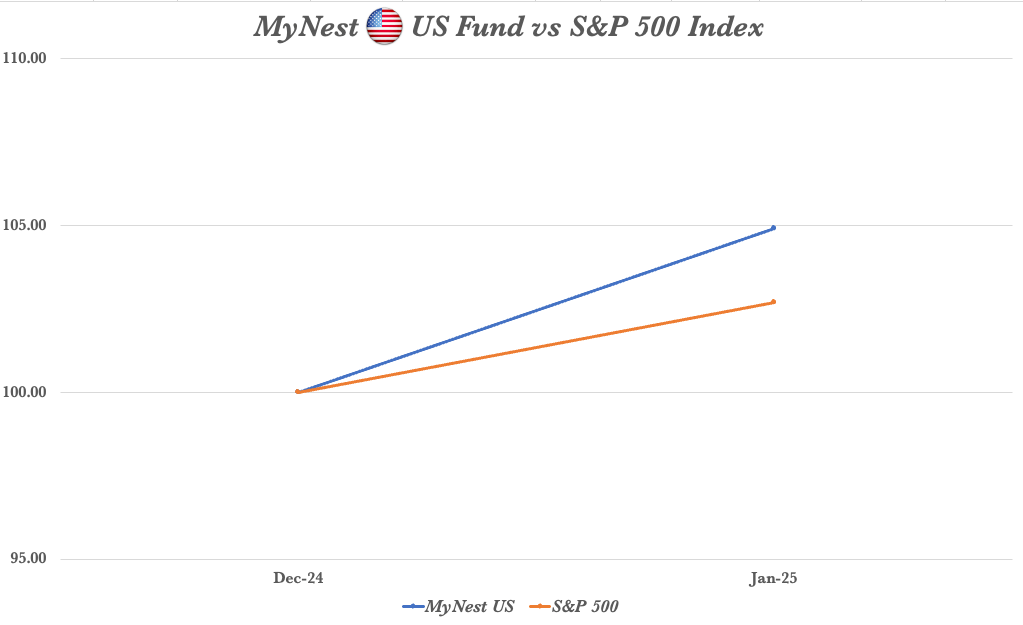

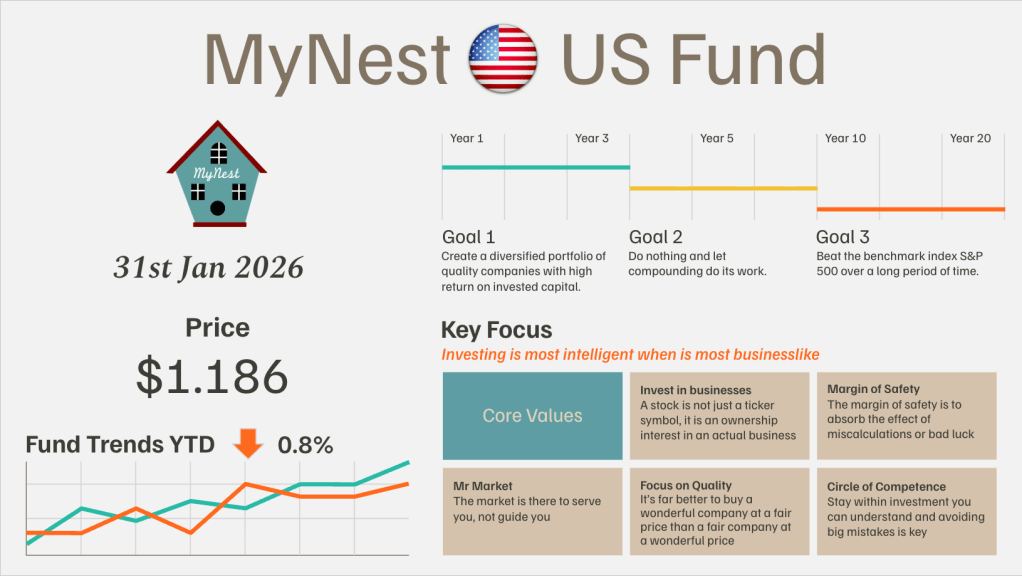

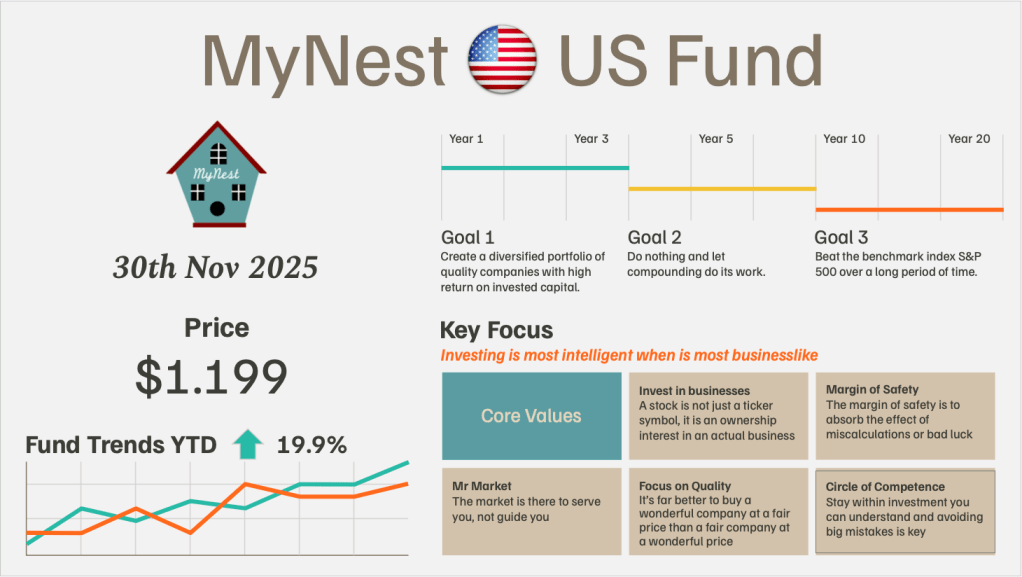

MyNest US Fund Performance

MyNest US Fund moved slightly ahead of the S&P 500 due to the index concentration of AI related companies. This had allow our US Fund to ahead by 2% grabbing the lead early in the year. The performance however will ultimately be determined how well the Fund’s portfolio of companies do during this earnings season.

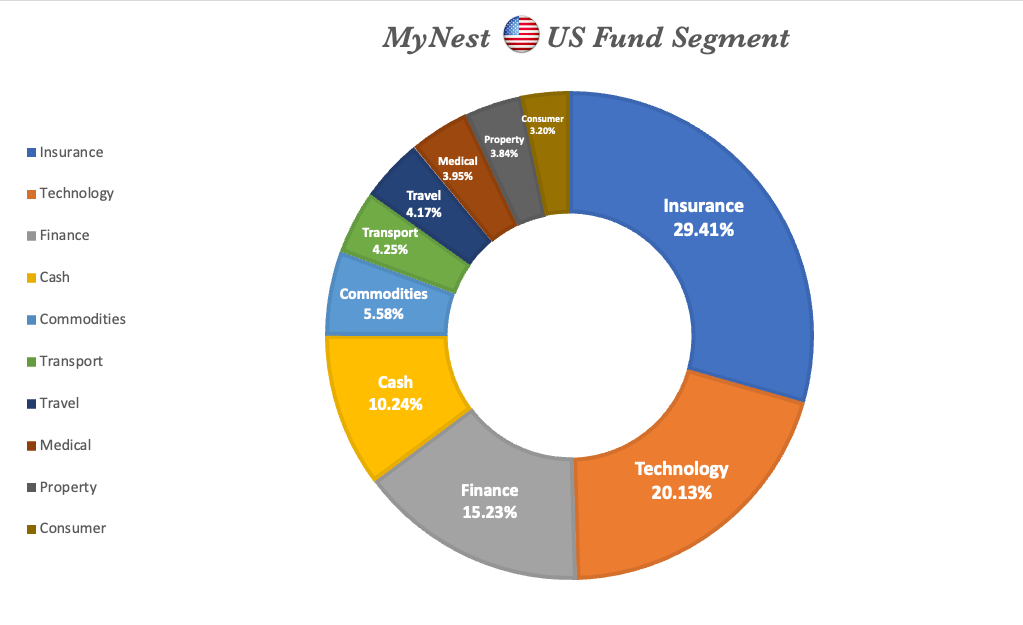

Segment Analysis

Segments were little changed as the slight uptrend movement of the market lifted most segments.

-

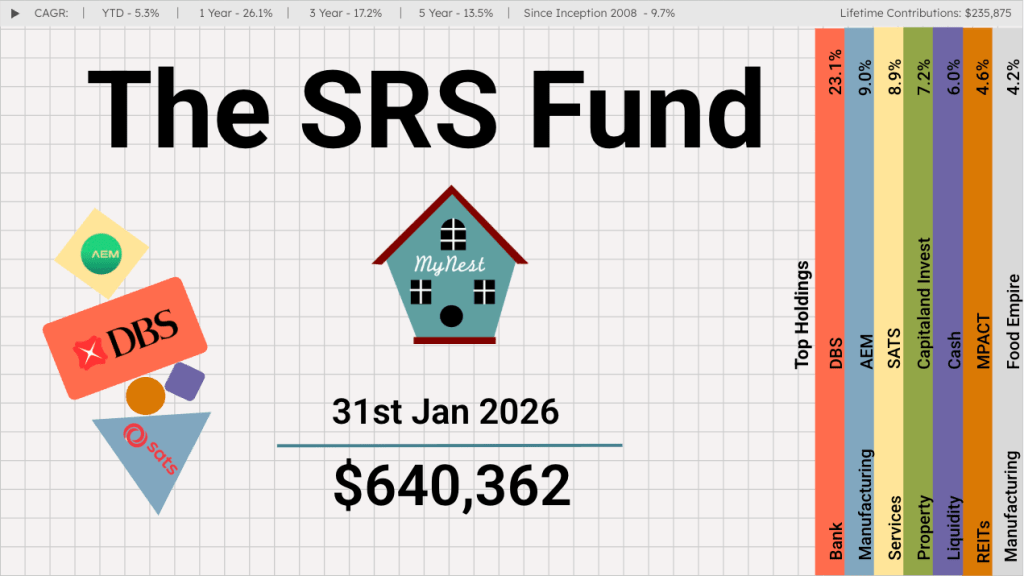

The SRS Fund Jan 2026

After a blockbuster 2025 that saw GDP growth hit a surprise 4.8%, the first month of 2026 has proven that the momentum is far from a fluke. Between record-breaking stock market performance and massive industrial investments, the “Little Red Dot” is making a very big noise.

-

MyNest US Fund Jan 26

I have a confession to make. After reading Chip War at the end of 2022, I fully grasped the strategic importance of TSMC and ASML in the global semiconductor supply chain.

-

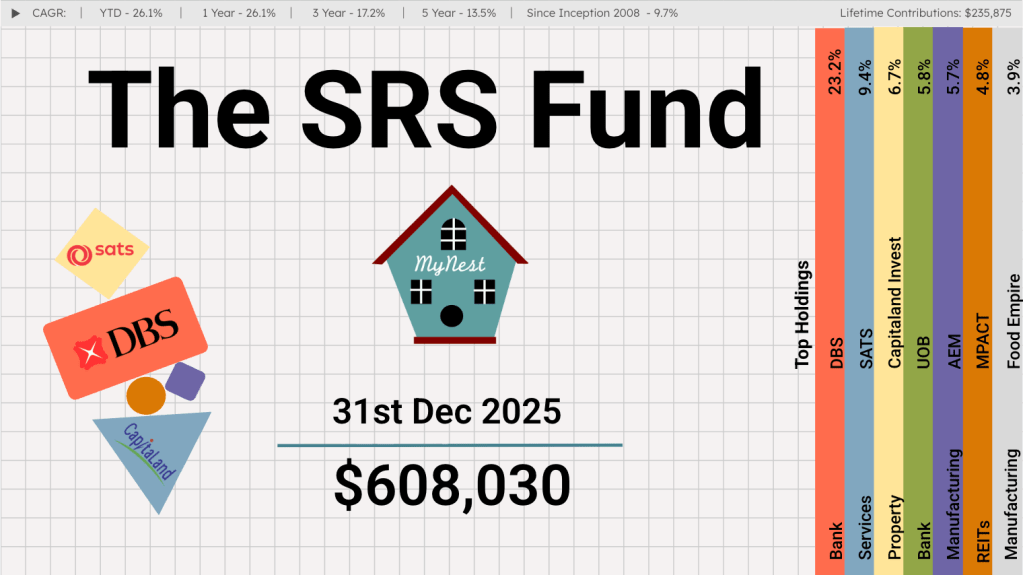

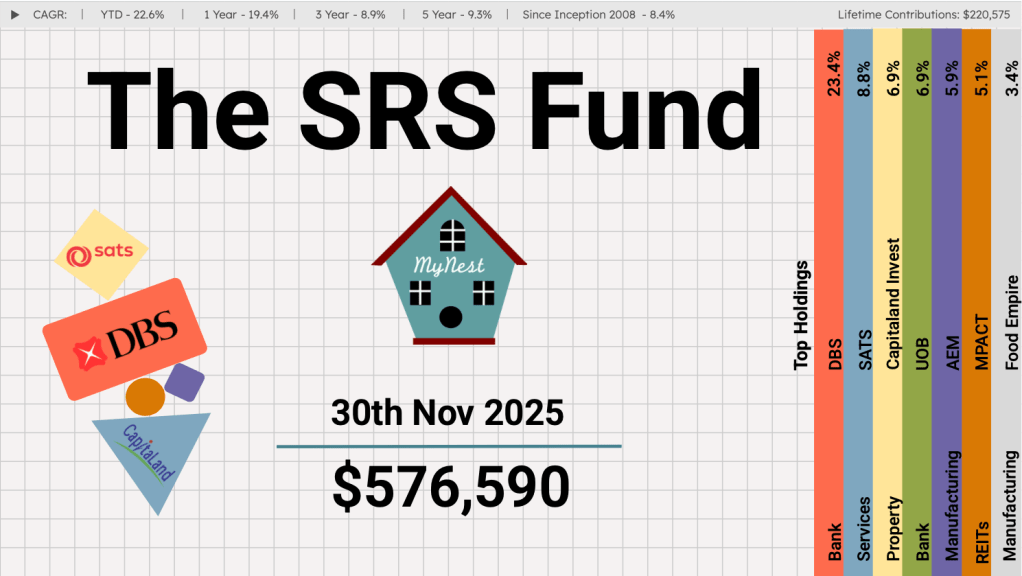

The SRS Fund Dec 2025

If someone had told me at the start of the year that the Singapore stock market would deliver returns in excess of 20%, I would have shrugged it off as wishful thinking.

-

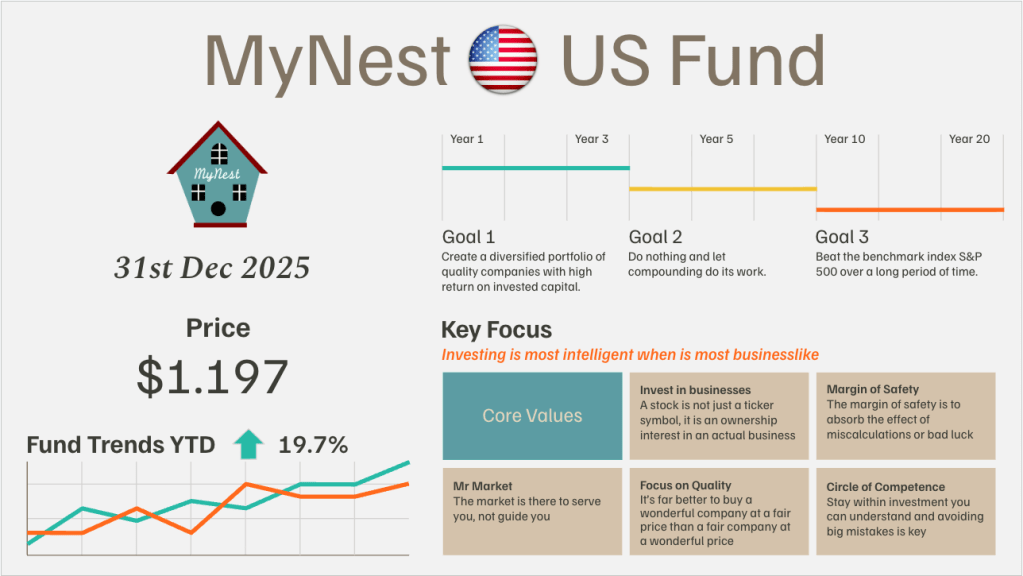

MyNest US Fund Dec 25

MyNest US Fund rounded the first year of inception with a slight outperformance to our benchmark the S&P 500. The first year of operation tested to resolve in knowing what we own as we navigated volatility which started on Trump’s Liberation Day.

-

The SRS Fund Nov 2025

If you’ve been watching the Singapore market this past month, the narrative has been impossible to ignore: it is a tale of three banks, and unfortunately for UOB, it has found itself lagging its peers.

-

MyNest US Fund Nov 25

November tested the patience of the broader market, defined by a distinct shift in sentiment regarding Artificial Intelligence. The narrative of an “AI Bubble” finally took hold,