Conviction in Singapore Banks

Singapore Banks, namely DBS, UOB and OCBC had a nice run up over the past 2 years as short-term interest rates heightened after record inflation due to record money printing during the Covid Pandemic

Now in 2025, local interest rate has reversed dramatically with 3 month Sora shaving more than 100 basis points within 6 months. The current Sora rate now hovers at only a mere 1.53%

With the significant decline in interest rates, local banks are feeling the pressure on their interest margins. From margins in excess of 2%, all three banks are forecasting sub-2% margin rates over the next few years.

With this margin decline, investors should expect banks’ earnings to fall accordingly. However, it is during times of such concern that I found the conviction to continue investing in banks.

I found my answers in historical data. Even during the worst years of the low-interest-rate environment, net interest margin has not fallen below 1.45%. This points to net interest margin as a factor of the banks’ profitability is limited.

Hence, my conclusion is that banks’ earnings will remain flat going forward, rather than decline significantly due to margin compression. More importantly, factors affecting profitability include their ability to control risk, also known as their rate of default.

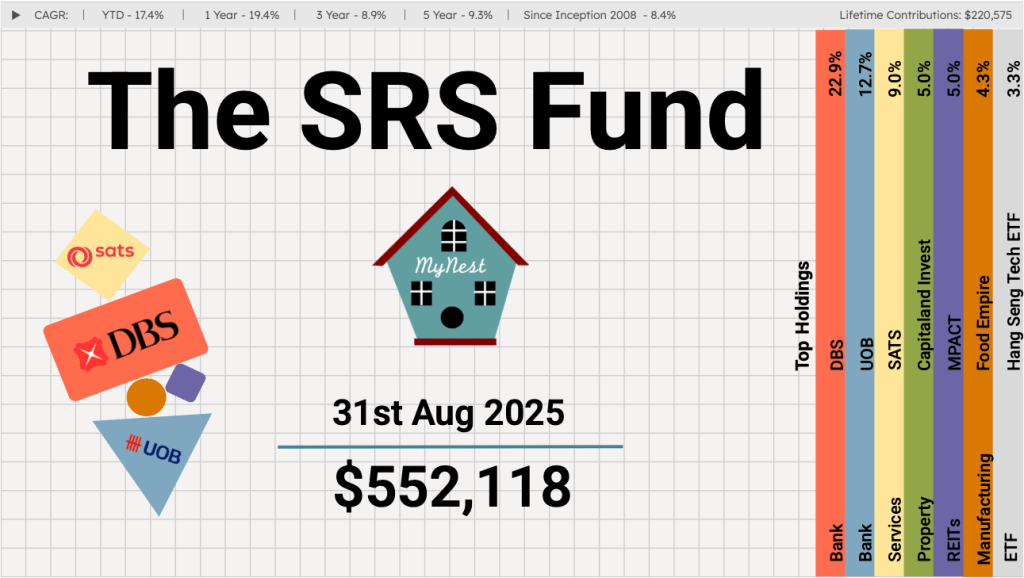

Singapore Bull Market and SRS Record

With the local stock market bull well on its way, the SRS fund recorded another month of gain to $552,118. Up 17.4% year to date, it has opened up a 4.7% lead over the STI index after taking into account the dividends received.

With interest rates expected to decline, I anticipate the interest rate-sensitive sector will benefit and begin to show in their numbers starting with the next earnings report.

Changes in the SRS Fund

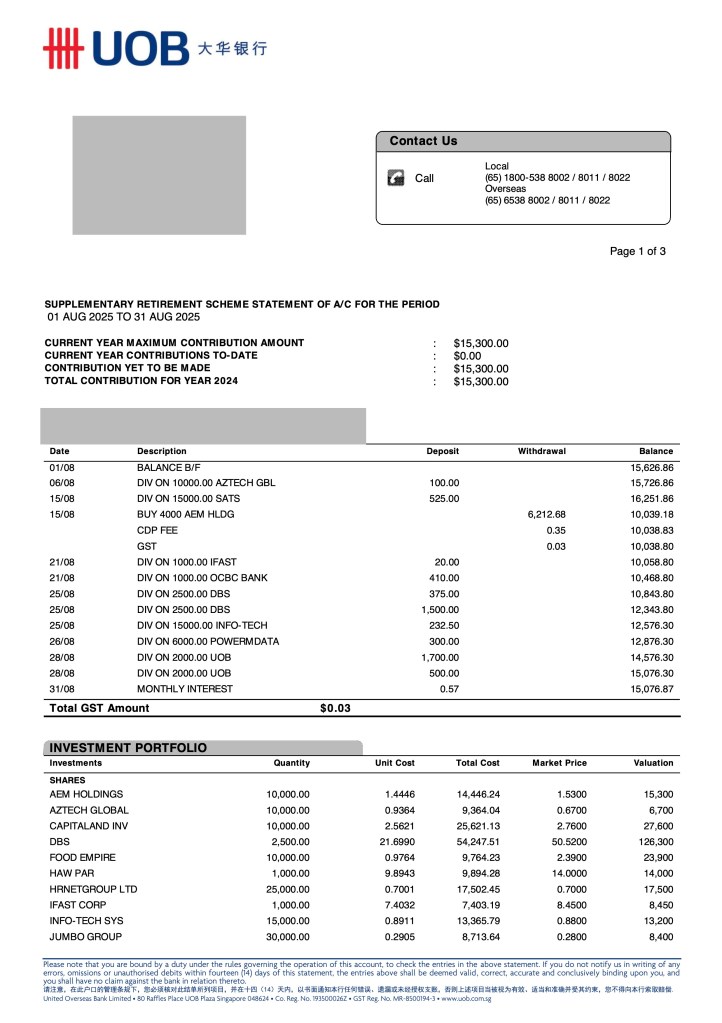

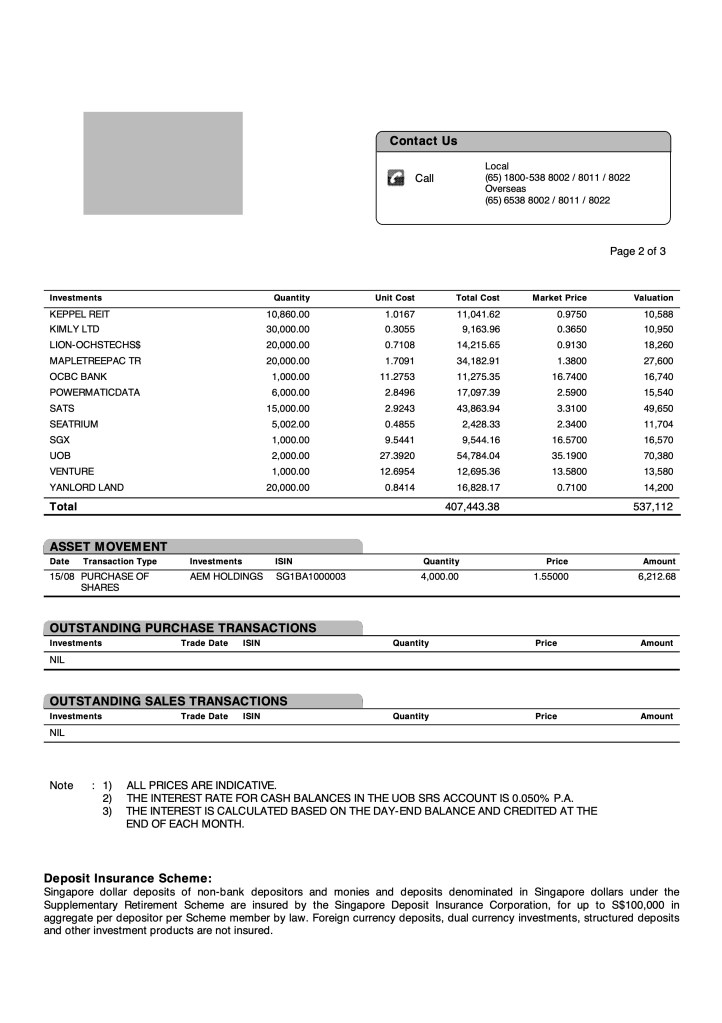

The SRS Fund doubles down on Powermatic data due to their willingness to return any profits from the sale of the food factory building. Further with Wifi 7 getting more prevalent, I hope the company can build on their capabilities and deliver good earnings as the technology matures.

During the month we also added more of AEM Holdings as it appears the company is turning the corner and coming back to profitability. Intel which is their biggest customer also had its fortune turn around as the US government announce to take a 10% stake in the company.

Portfolio Segments

The SRS Fund continues to have a nice segment mix as finance remains the biggest contributor to the portoflio, followed by the service segment.

Dividends

Dividend collection so far in Q3 is $5,962.50, on track to exceed last year’s record. Companies within the portfolio in general remained as profitable or even more profitable than in 2024.

SRS Fund Value

Total SRS Fund value hit a record high at $552,188.87. This is up 17.3% for the year versus the STI 12.7%.

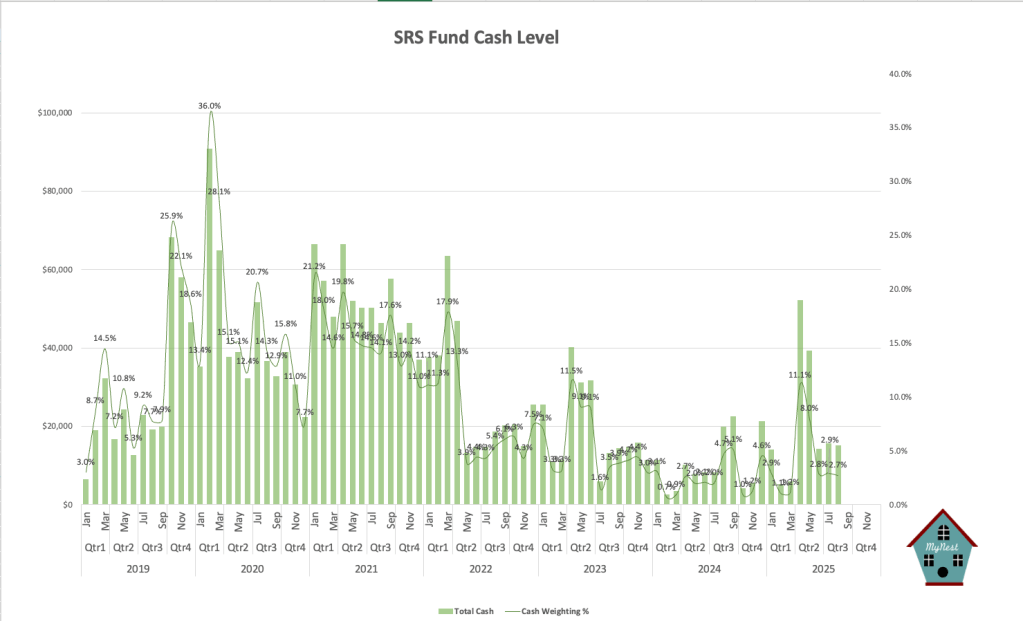

Cash Levels

Low cash level is a blessing during this bull market as it means most of the SRS Fund is working extra hard for good returns. The Singapore market as well as the Singapore economy, looks to close 2025 as a bumper year despite the global uncertainty that looms with the trade war.

-

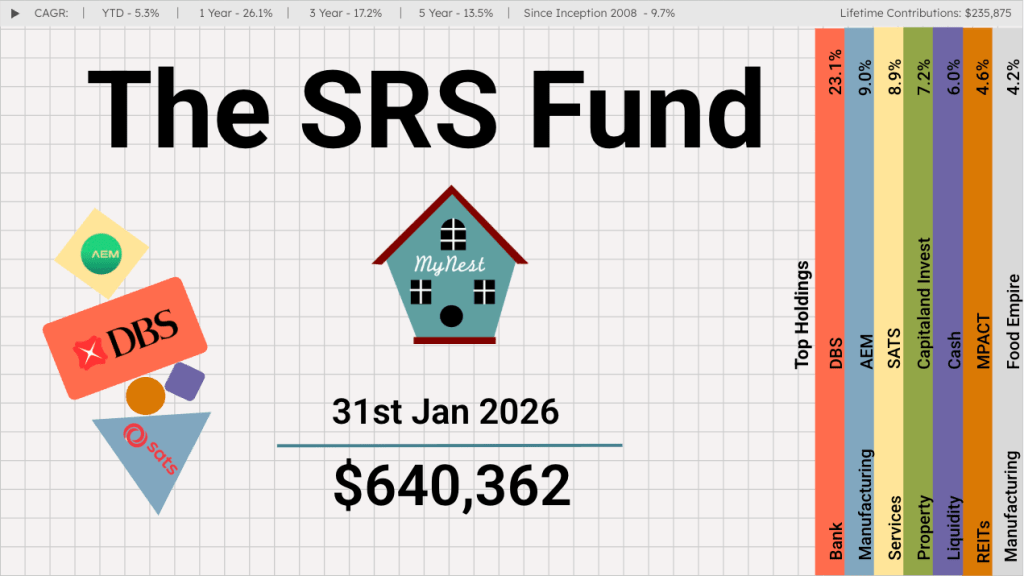

The SRS Fund Jan 2026

After a blockbuster 2025 that saw GDP growth hit a surprise 4.8%, the first month of 2026 has proven that the momentum is far from a fluke. Between record-breaking stock market performance and massive industrial investments, the “Little Red Dot” is making a very big noise.

-

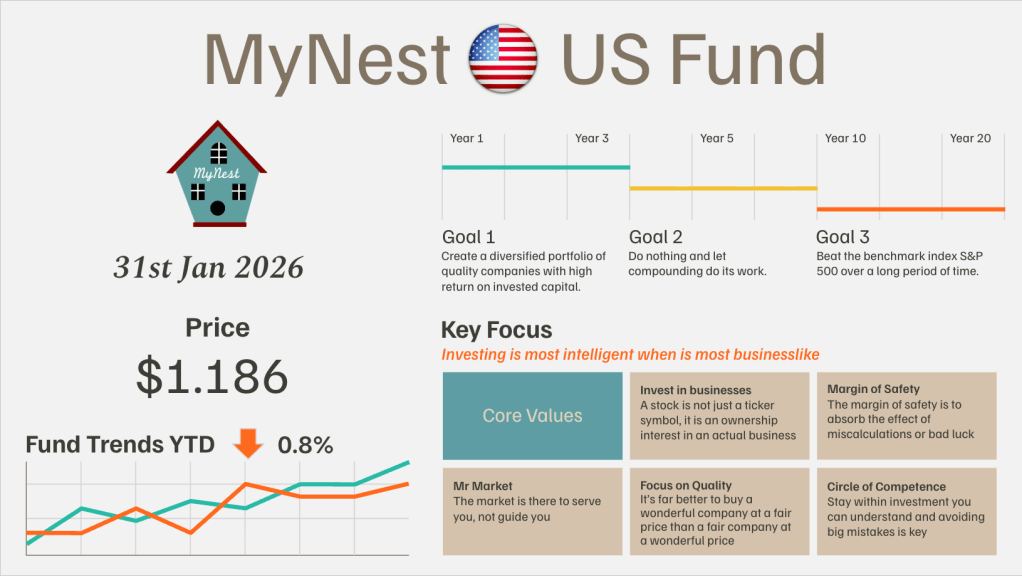

MyNest US Fund Jan 26

I have a confession to make. After reading Chip War at the end of 2022, I fully grasped the strategic importance of TSMC and ASML in the global semiconductor supply chain.

-

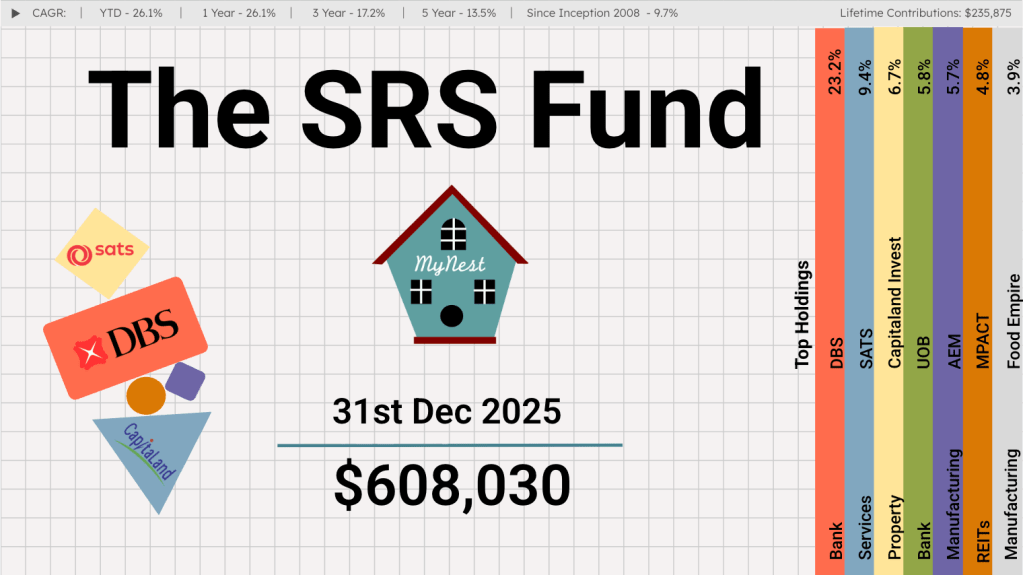

The SRS Fund Dec 2025

If someone had told me at the start of the year that the Singapore stock market would deliver returns in excess of 20%, I would have shrugged it off as wishful thinking.

-

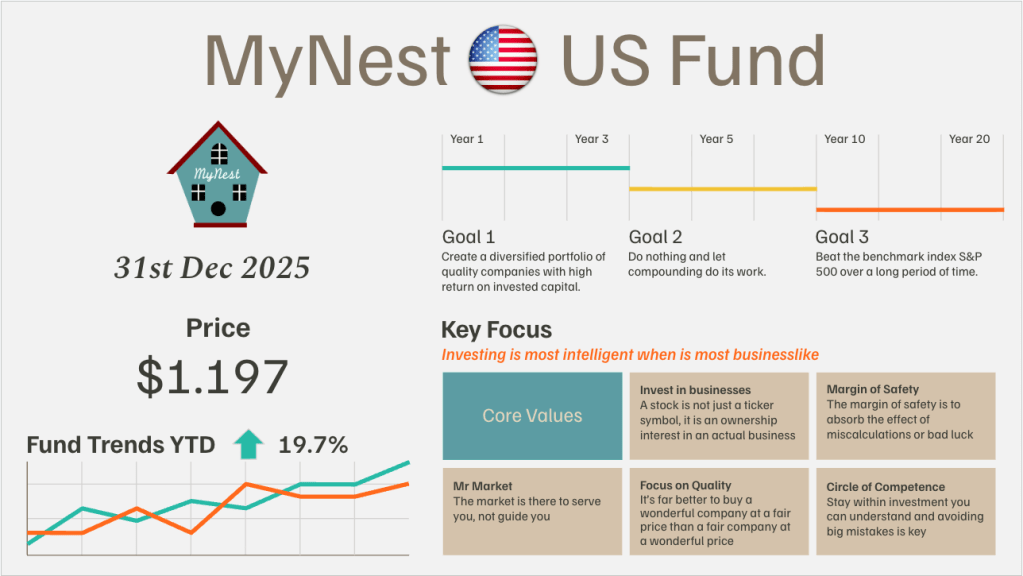

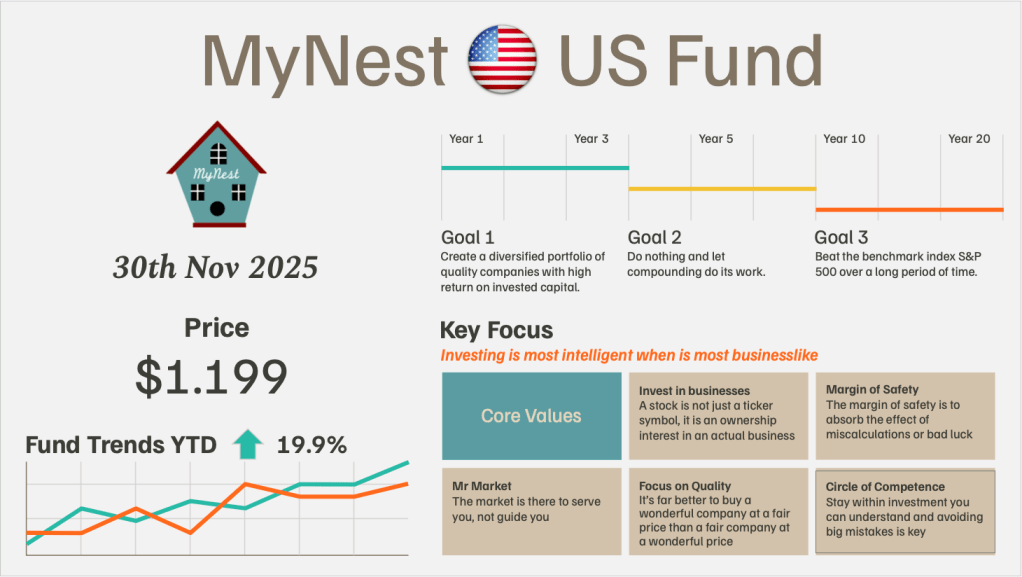

MyNest US Fund Dec 25

MyNest US Fund rounded the first year of inception with a slight outperformance to our benchmark the S&P 500. The first year of operation tested to resolve in knowing what we own as we navigated volatility which started on Trump’s Liberation Day.

-

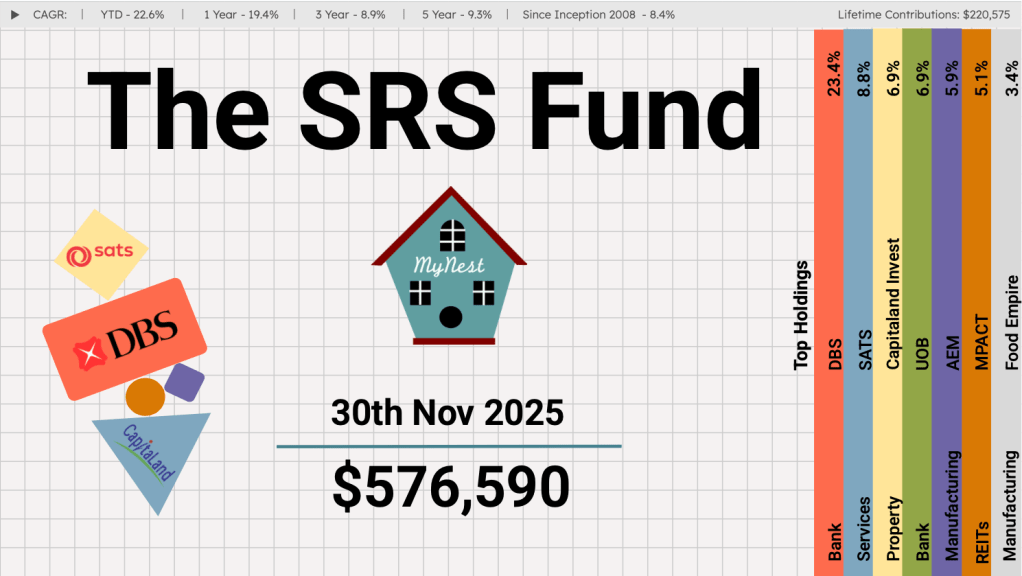

The SRS Fund Nov 2025

If you’ve been watching the Singapore market this past month, the narrative has been impossible to ignore: it is a tale of three banks, and unfortunately for UOB, it has found itself lagging its peers.

-

MyNest US Fund Nov 25

November tested the patience of the broader market, defined by a distinct shift in sentiment regarding Artificial Intelligence. The narrative of an “AI Bubble” finally took hold,