Is Offical, the Singapore Bull is Raging

The Singapore market had been one of the most underperforming stock market in the world for the past 10 years. Since reaching a high of 3,900 in 2007, it took more than 12 years for this peak to be surpassed in 2025.

The change in sentiment is driven by 2 main factors. The first is the improvement of fundamentals since Covid 19 as our island attracted many wealthy individuals. This allow our local banks to provide wealth management services as well as loans to this high net worth individuals.

The second factor is the shift in the stance of our government on how it views the stock market. After the penny stock crisis in 2013 which many retail investors got burned, the authorities clamped down hard on speculation in the stock market.

One can only imagine a stock market without speculation can be liked. IPO dried up, and traders moved elsewhere. The entire equity industry was left in a doldrum.

It was only when this newly elected government realised that a vibrant financial centre would need a vibrant stock market that things were put into motion.

The shift of mindset from zero speculation to some speculation is needed and allows for changing the perception. Further, a $5b injection by the government into listed small and medium firms will encourage participation by more retailers.

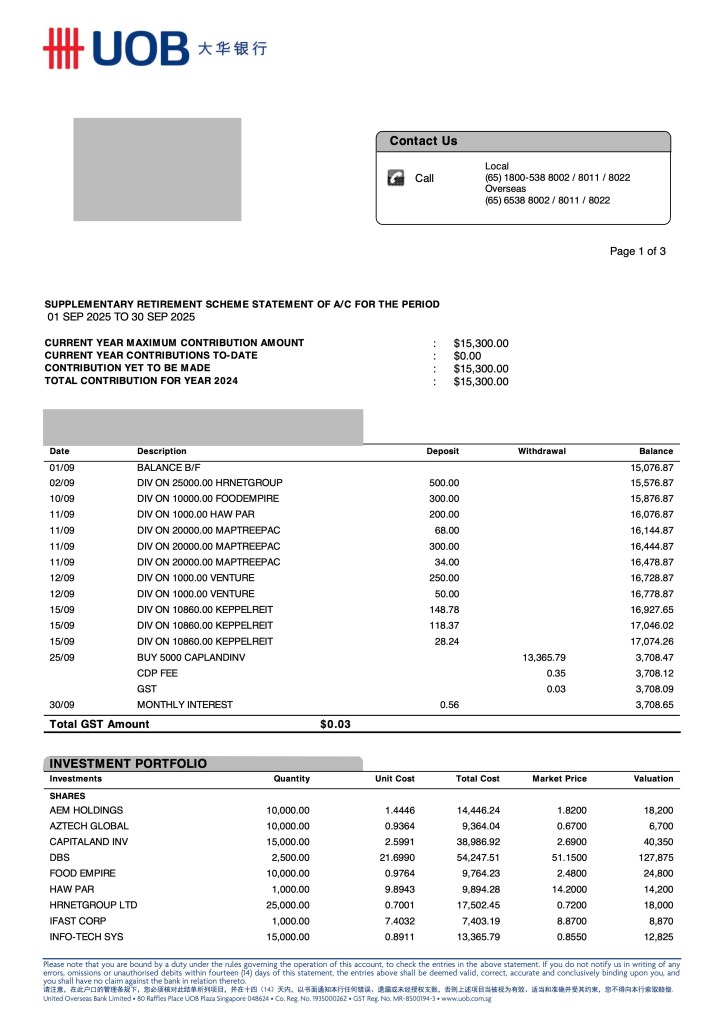

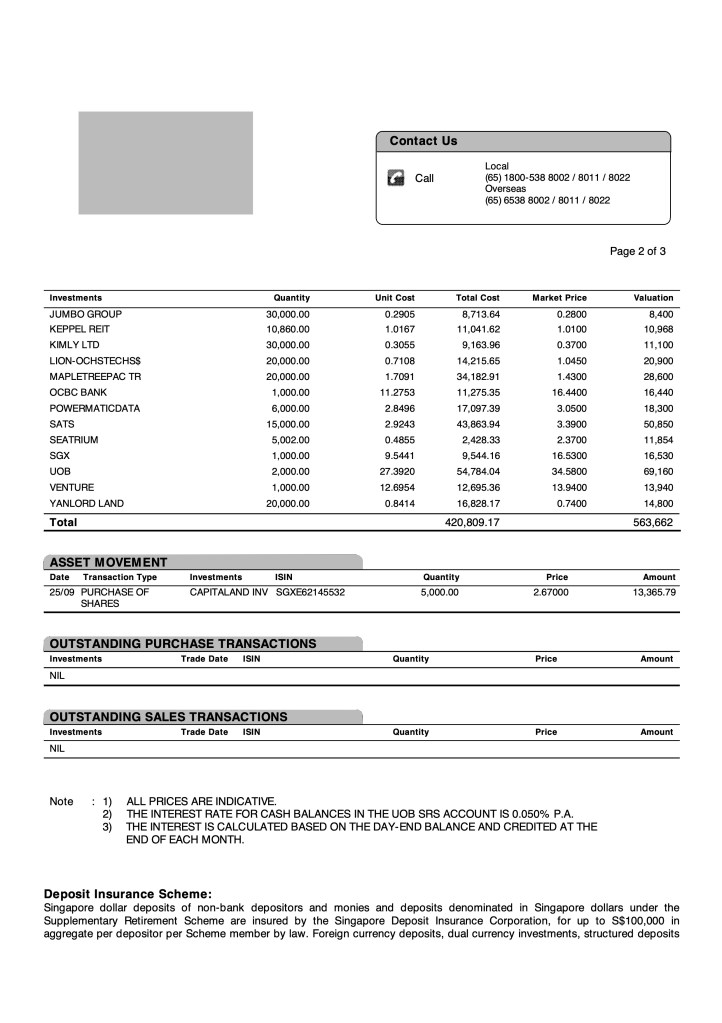

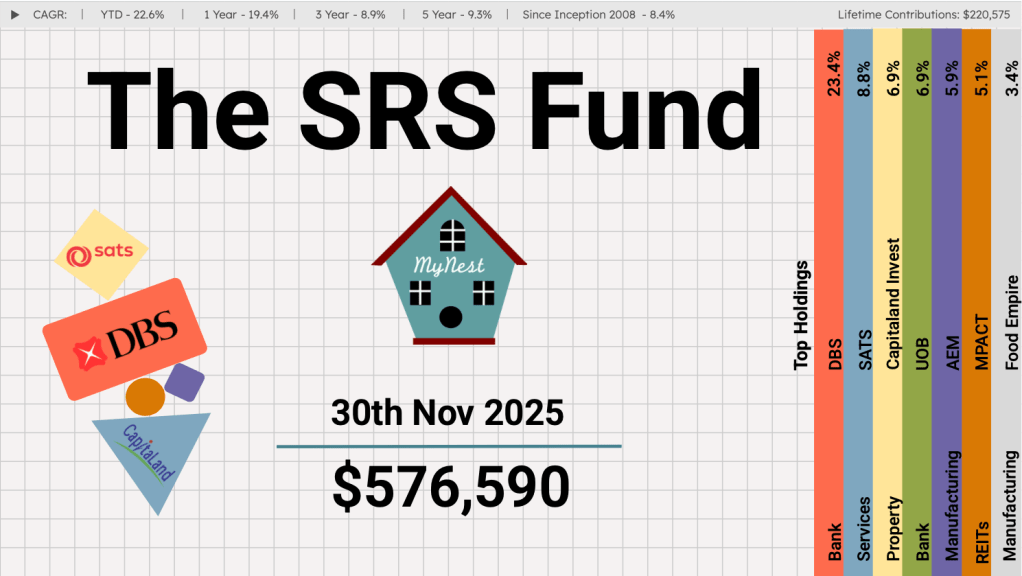

SRS Record after Record

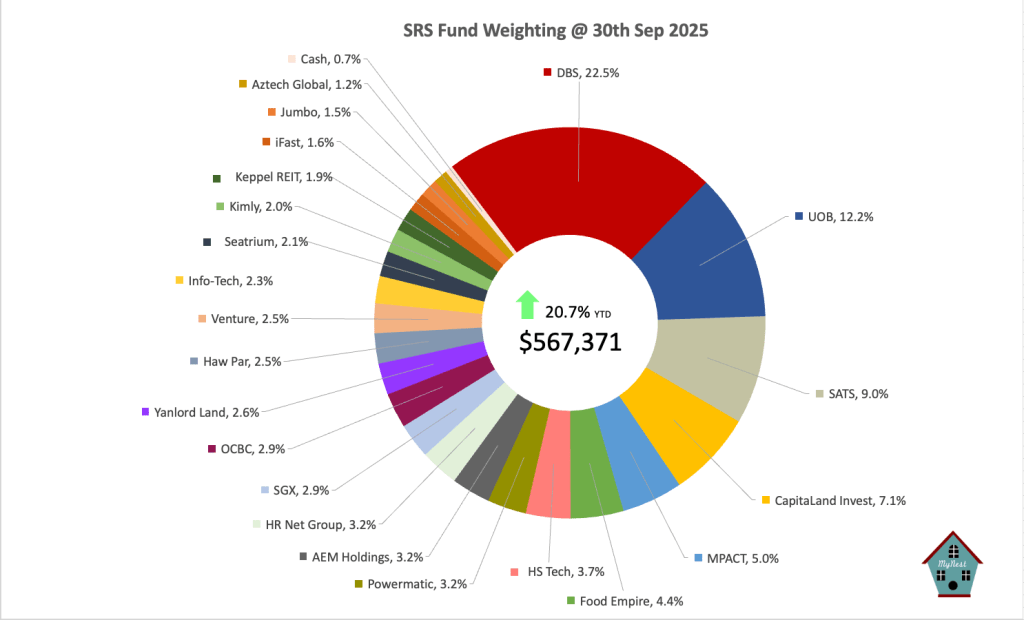

The SRS fund recorded another stellar month of gain, reaching $567,371 in value. Up a whopping 20.7% year to date. The lead of its benchmark, the STI index, stands at nearly 7.1% before including the index dividend.

Changes in the SRS Fund

More share of Capitaland Invest was purchased during the month in anticipation of the benefits from its successful IPO of its China REIT, as well as a lower interest rate environment.

Portfolio Segments

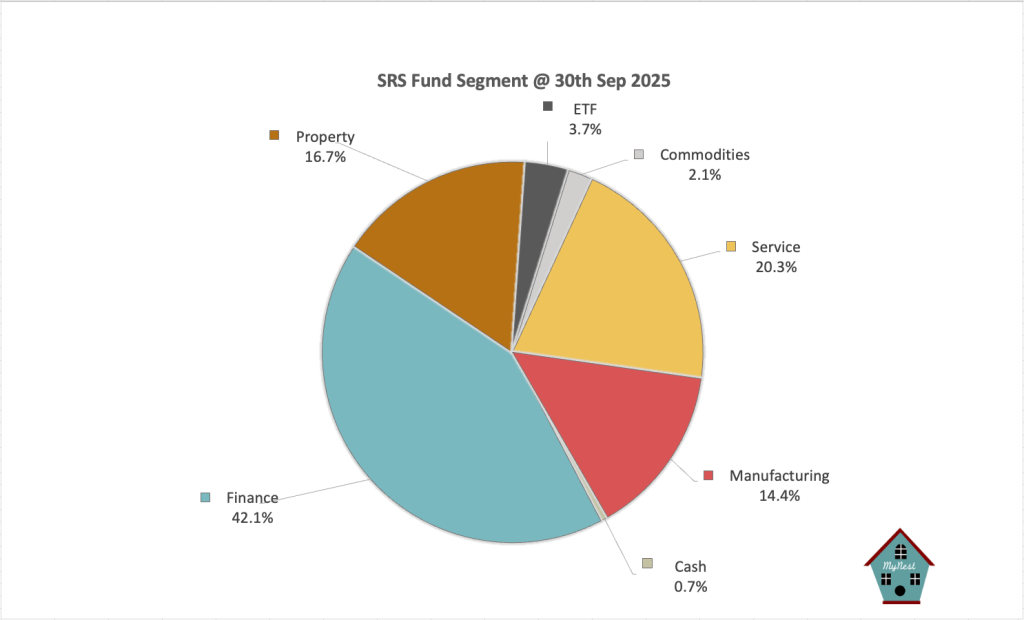

The SRS Fund continues to have a nice segment mix as finance remains the biggest contributor to the portoflio, followed by the service segment.

Dividends

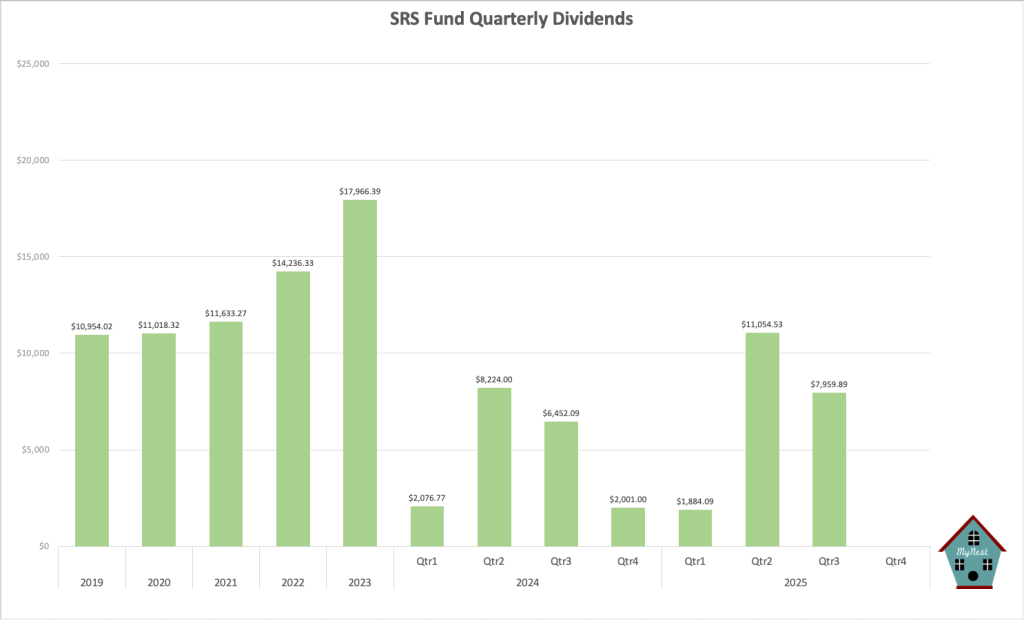

Q3 dividend exceeded the previous year comfortably reaching $7,959.89. Dividend in Q4 is expected to be subdued due to fewer companies paying dividends during this period.

SRS Fund Value

Total SRS Fund value hit another record high at $567,371.99. This is up 20.7% for the year versus the STI 13.5%.

Cash Levels

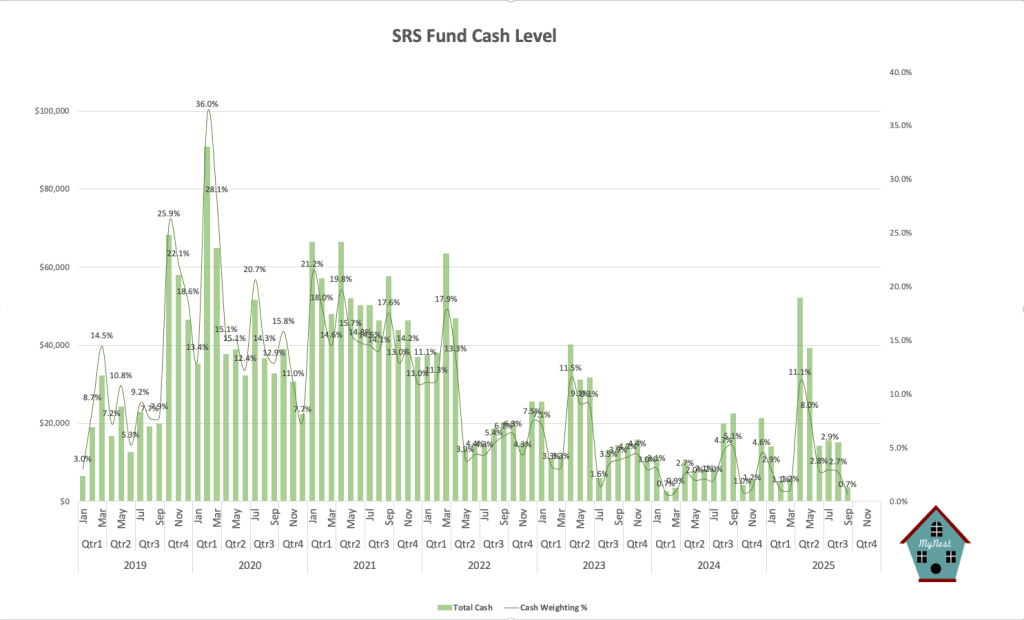

Cash level reached a record low of 0.7% as I aim to maximise time in the market versus timing the market in this bull run.

-

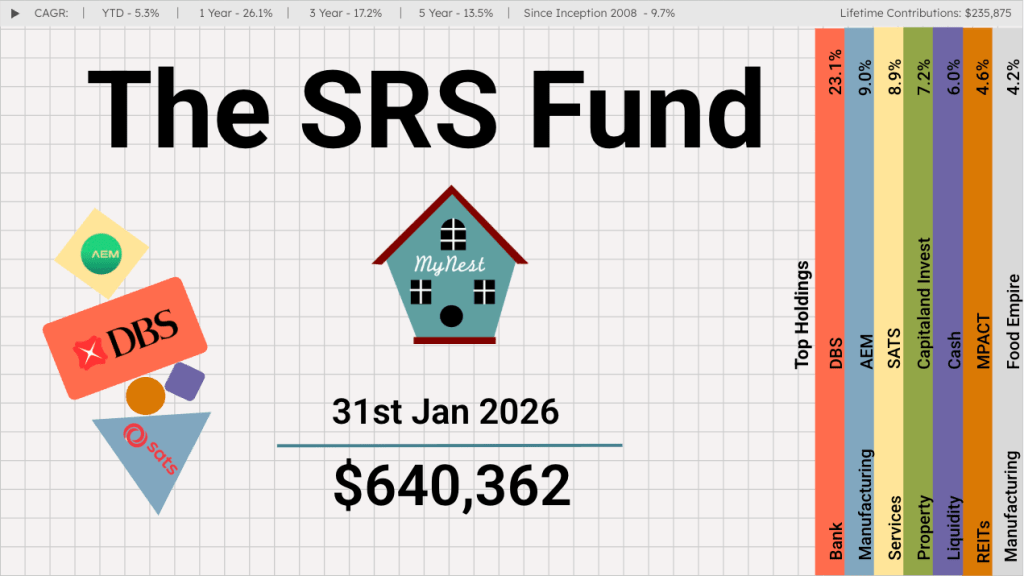

The SRS Fund Jan 2026

After a blockbuster 2025 that saw GDP growth hit a surprise 4.8%, the first month of 2026 has proven that the momentum is far from a fluke. Between record-breaking stock market performance and massive industrial investments, the “Little Red Dot” is making a very big noise.

-

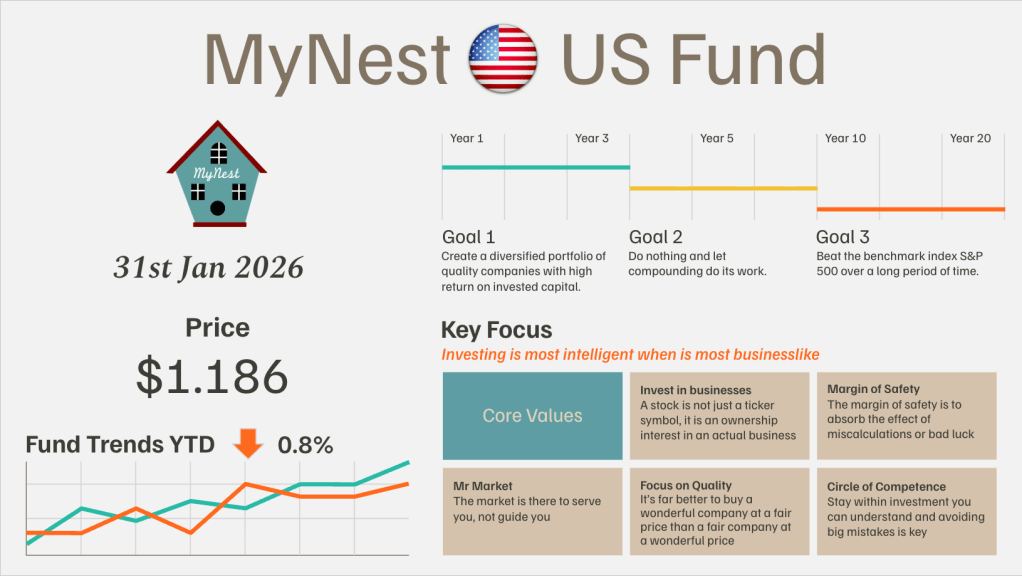

MyNest US Fund Jan 26

I have a confession to make. After reading Chip War at the end of 2022, I fully grasped the strategic importance of TSMC and ASML in the global semiconductor supply chain.

-

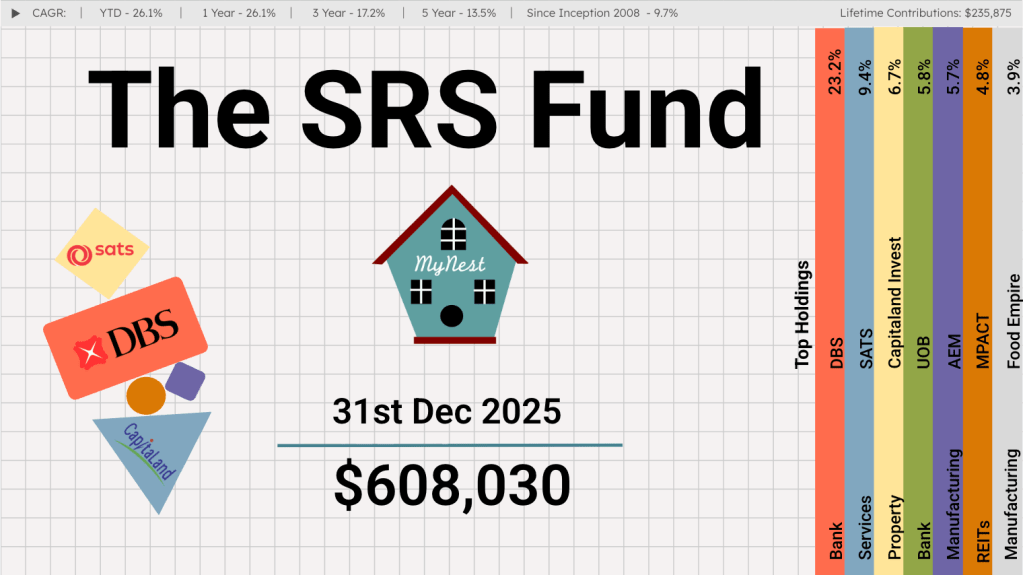

The SRS Fund Dec 2025

If someone had told me at the start of the year that the Singapore stock market would deliver returns in excess of 20%, I would have shrugged it off as wishful thinking.

-

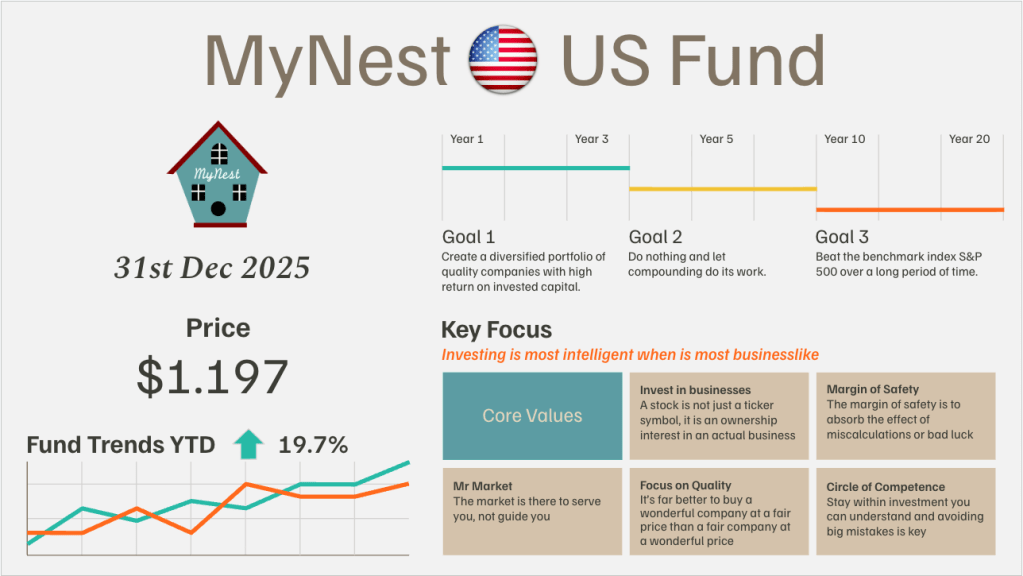

MyNest US Fund Dec 25

MyNest US Fund rounded the first year of inception with a slight outperformance to our benchmark the S&P 500. The first year of operation tested to resolve in knowing what we own as we navigated volatility which started on Trump’s Liberation Day.

-

The SRS Fund Nov 2025

If you’ve been watching the Singapore market this past month, the narrative has been impossible to ignore: it is a tale of three banks, and unfortunately for UOB, it has found itself lagging its peers.

-

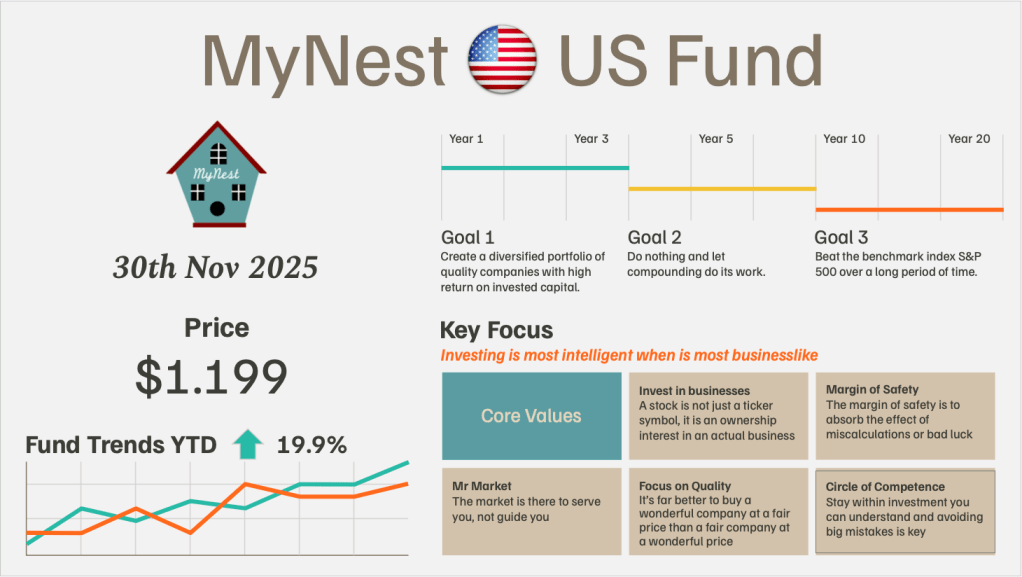

MyNest US Fund Nov 25

November tested the patience of the broader market, defined by a distinct shift in sentiment regarding Artificial Intelligence. The narrative of an “AI Bubble” finally took hold,