Dear Investors,

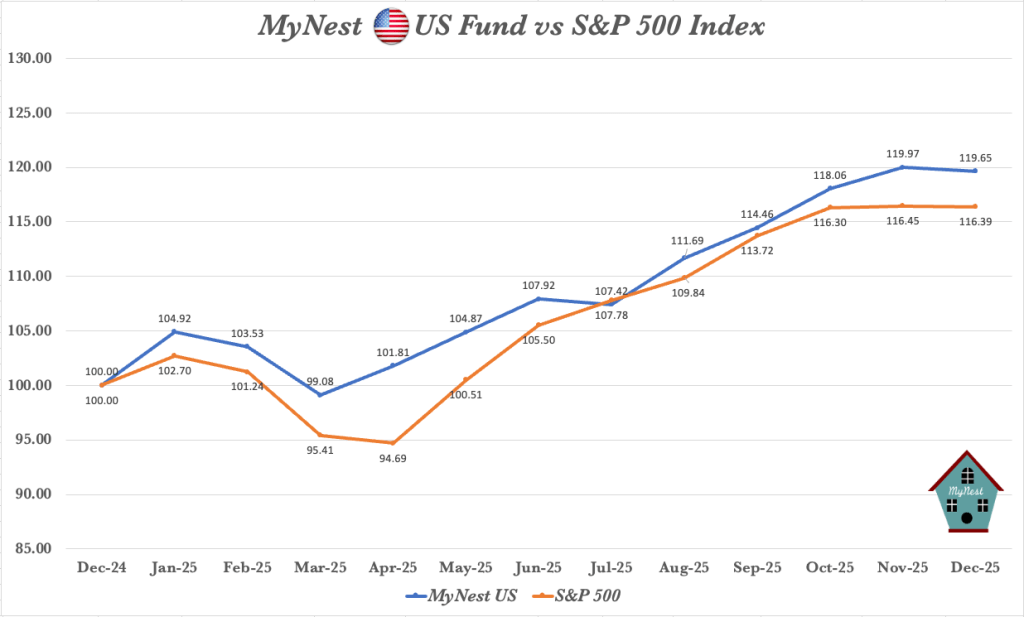

MyNest US Fund rounded the first year of inception with a slight outperformance to our benchmark the S&P 500. The first year of operation tested to resolve in knowing what we own as we navigated volatility which started on Trump’s Liberation Day.

As the year end, I would like to take the opportunity to thank you for the trust place in the fund. I will never take managing your fund lightly even though our fund don’t charge a fee. Treating your investment as hard earned money saved for life changing event will always be on my mind.

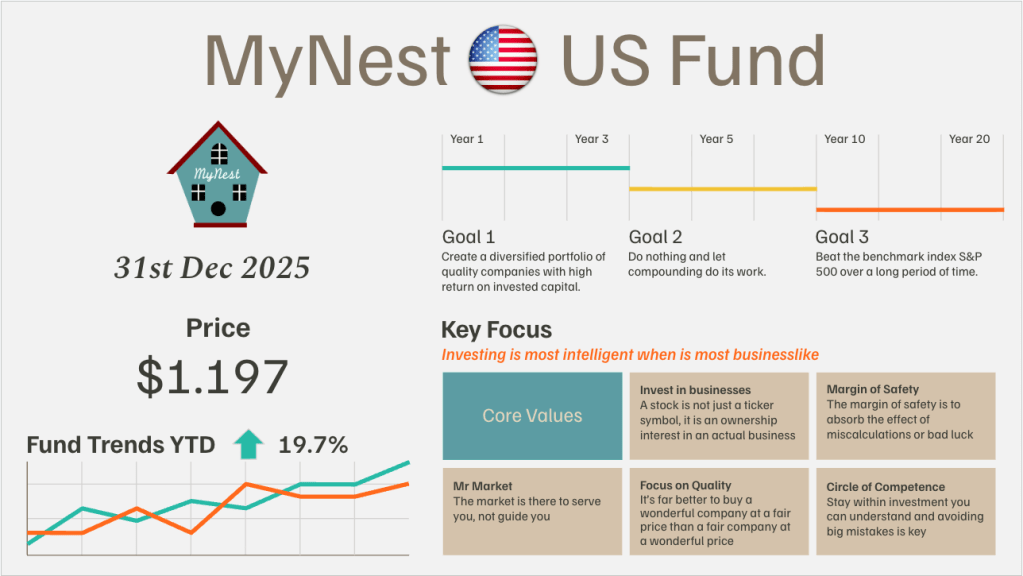

With that said I am happy to report that MyNest US Fund delivered a return of 19.7% for the year versus our benchmark of 16.4%. Our price per unit stand at $1.197. While I can’t promise such a return every single year, what I can do is to manage the fund to the best of my ability and have at least most of my networth also invested together.

A Year of AI in the Making

2025 was undeniably the year of AI infrastructure. The ball started rolling early in the year when OpenAI – backed by the colossal financial firepower of Microsoft and Softbank – unveiled the “Stargate” initiative. With a pledge to invest hundreds of billions into AI infrastructure, data centers and energy solutions, they didn’t just signal demand; they effectively floored the accelerator for the entire tech industry. This was not just about chatbots anymore; it was about national competitiveness, energy grids and the physical backbone of the future economy.

The Asymmetrical Bet: Why Google?

Coming into 2025, the street viewed Google as a legacy giant at risk of disruption. We took a contrarian view, placing essentially an “asymmetrical” bet believing Google was the only player capable of synthesizing the old world (massive, high-margin Search utility) with the new world (Generative AI)

That bet paid off spectacularly

- The Ad Engine: Contrary to fears, Search didn’t die. It evolved. Google proved it could protect its core ad revenue moat even as user behaviour shifted

- The Most Intuitive Model: By year-end, Google silenced the critics by deploying the most intuitive AI model on the market, integrating it seamlessly into their ecosystem rather than leaving it as a standalone novelty

We didn’t buy a ticker; we bought ownership in a business with a fair “Margin of Safety” that the market ignored.

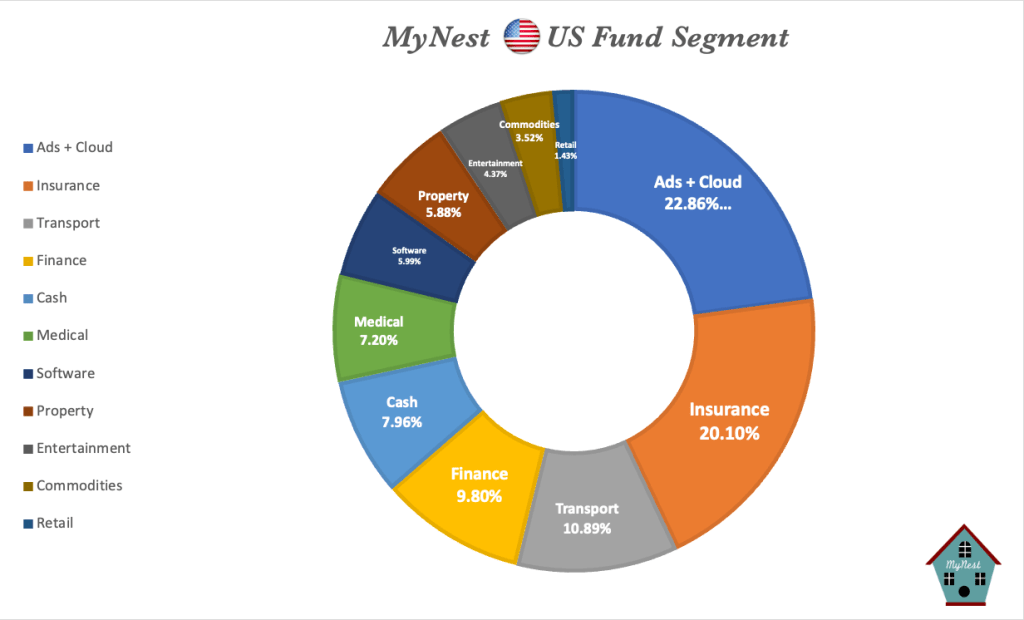

MyNest US Fund Portfolio Compositions

Our fund portfolio is robustly constructed over time, designed to let us sleep well.

- Insurance (20.1%) : Our second largest segment led by Markel and Berkshire Hathaway, continues to provide the steady float that underpins our strategy. Markel, often called “Baby Berkshire”, remains a quiet compounder in the background.

- Google (20.8) : A giant conglomerate at the forefront of AI and a slew of promising business in Search, Cloud, Youtube and more with exceptional optionalities.

- Uber & The Gig Economy (10%) : Uber remains a top 5 holding. Their continued dominance in mobility and delivery logistics is turning them into a utility-like staple in our Transport segment.

- The Cash Buffer (7.9%) : We are carrying a healthy cash position. While some might call this a drag in a rising market, we view it as optionality. With the unit price at nearly $1.19, we have dry powder ready for any volatility the future may bring.

MyNest US Fund Performance

The S&P 500 look anything but strong going into the new year. Our alpha over the index has been close at 3.26%. I predict the gap will likely close as we head higher as the AI narrative continue to drive sentiments.

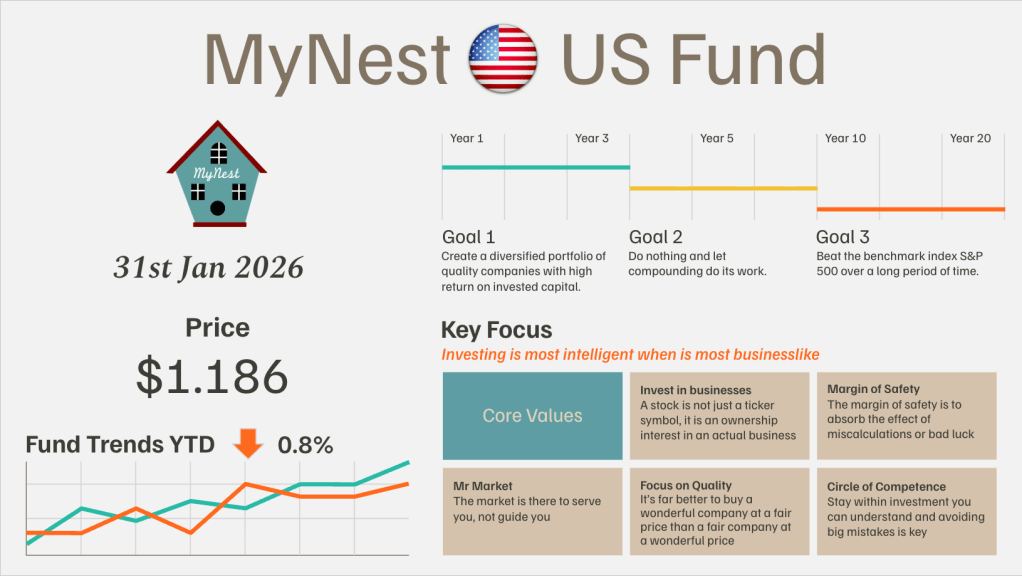

We remain focused on the three core goals:

- Diversify into quality companies with high returns on capital

- Do nothing and let compounding work

- Beat the benchmark over the long haul

Segment Chart

-

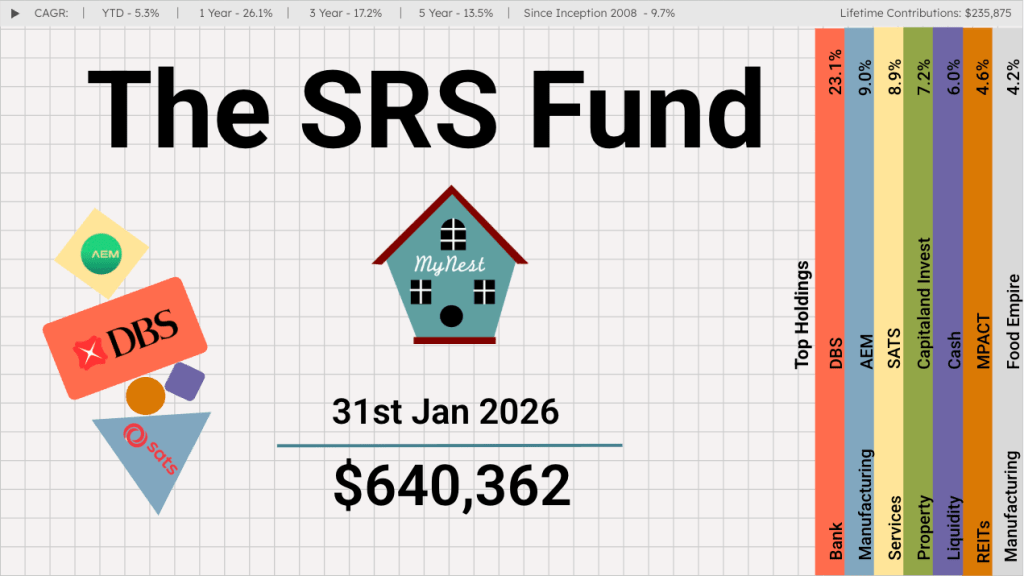

The SRS Fund Jan 2026

After a blockbuster 2025 that saw GDP growth hit a surprise 4.8%, the first month of 2026 has proven that the momentum is far from a fluke. Between record-breaking stock market performance and massive industrial investments, the “Little Red Dot” is making a very big noise.

-

MyNest US Fund Jan 26

I have a confession to make. After reading Chip War at the end of 2022, I fully grasped the strategic importance of TSMC and ASML in the global semiconductor supply chain.

-

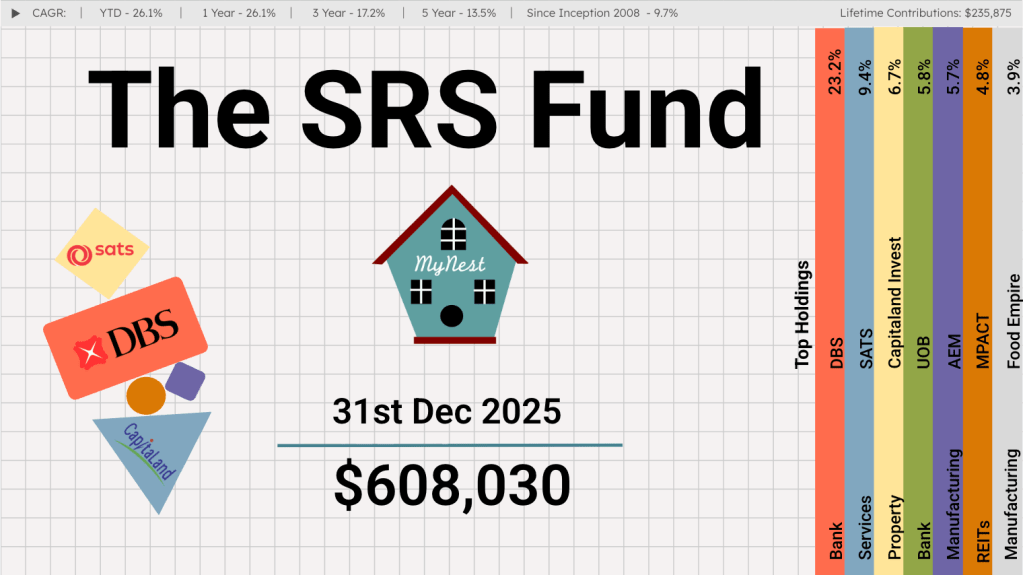

The SRS Fund Dec 2025

If someone had told me at the start of the year that the Singapore stock market would deliver returns in excess of 20%, I would have shrugged it off as wishful thinking.

-

MyNest US Fund Dec 25

MyNest US Fund rounded the first year of inception with a slight outperformance to our benchmark the S&P 500. The first year of operation tested to resolve in knowing what we own as we navigated volatility which started on Trump’s Liberation Day.

-

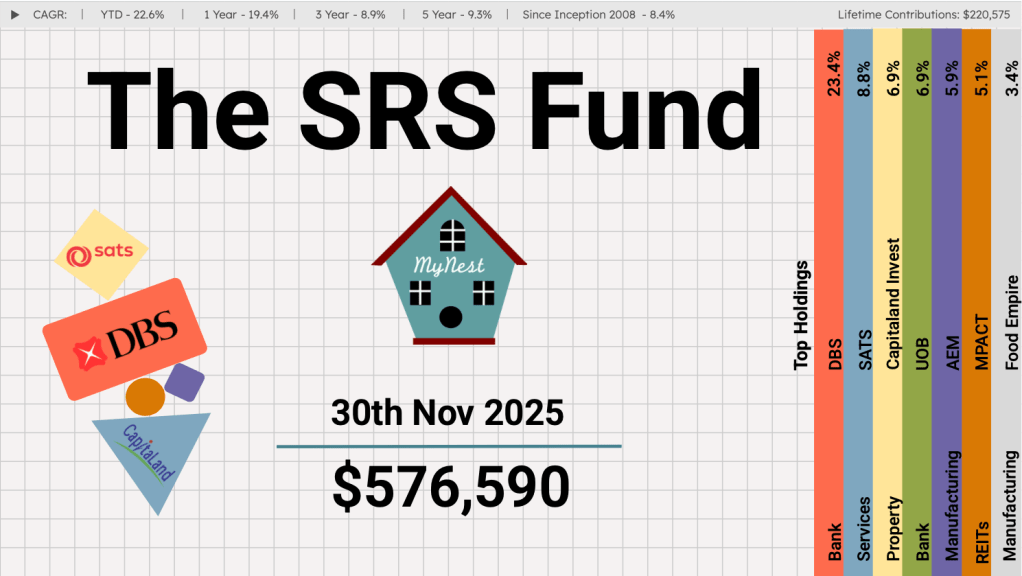

The SRS Fund Nov 2025

If you’ve been watching the Singapore market this past month, the narrative has been impossible to ignore: it is a tale of three banks, and unfortunately for UOB, it has found itself lagging its peers.

-

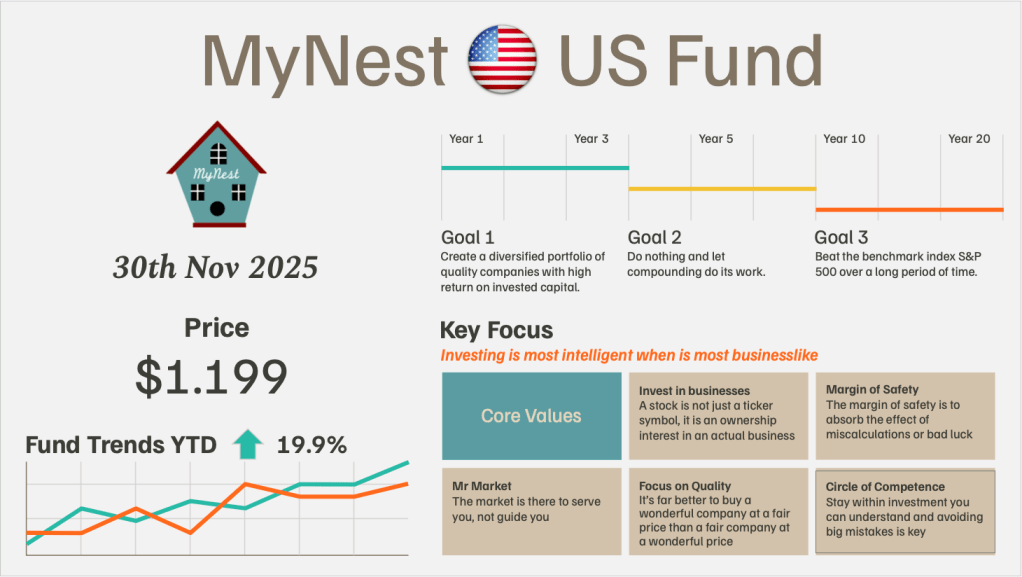

MyNest US Fund Nov 25

November tested the patience of the broader market, defined by a distinct shift in sentiment regarding Artificial Intelligence. The narrative of an “AI Bubble” finally took hold,